| 9% Boomers 52% Gen X 33% Gen Y/Millennials 6% Gen Z 45 Average Age | | 90% Overall Retention Rate 84% Under-Represented# Retention Rate 14 Average Years of Service | | 16% of Total Workforce 3,206 Veterans and non-Asian employees; (iv) Interchange Women’s Business Resource Group, which creates forums to engage aspiring women leaders on career and leadership development; (v) LGBTQ+A(llies), which focuses on advocacy, education, policy and community outreach in support of the LGBTQ+ community and engaging family and friends who serve as allies; (vi) Military Business Resource Group, which honors and supports CSX’s veterans or active-duty military employees, Pride in Service activities and employee families when their loved ones are deployed in active military service; (vii) STEAM, which focuses on sparking interest in technology and innovation among all employees in the areas of science, technology, engineering, art and math; and, as most recently added in 2022, (viii) Hispanic Origin/Latin American (HOLA) Business Resource Group, which is committed to the engagement and professional growth of CSX’s Hispanic and Latinx employees with a focus on recruitment, development, cultural awareness and community involvement. Commitment to Social Justice and Racial Equity

CSX is committed to social justice and racial equality—within our organization and throughout our communities. We are adding CSX’s voice to the side of anti-racism to not only meet our societal obligation but also to help strengthen our culture of inclusion. As we resolve to address social justice with purpose, we are continuing efforts with our own social justice advisory roundtable, a cross-functional group of CSX employees and leaders, to advance our efforts. This group reflects a diverse range of perspectives and expertise that has already increased dialogue around diversity, equity and inclusion at CSX and produced meaningful change for our employees and in our communities. Specifically, our social justice advisory roundtable is responsible for developing strategy and overseeing the Company’s social justice action plan. The internal portion of the plan includes specific items that directly impact employees and improve the corporate culture, ranging from anti-racism awareness seminars and development opportunities for people of color to voter education and changing potentially offensive job titles. Externally, the plan includes partnerships with organizations that promote anti-racism awareness and provide support for people and communities of color.

For example, in alignment with the Company’s strong stance against hate speech, racism and discrimination, CSX recently joined other Jacksonville organizations and business leaders to promote diversity, equity and inclusion by contributing $100,000 to the newly formed Together Strong Community Fund. Backed by multiple large Jacksonville-based companies, the fund will use education, conversation and interaction initiatives to address antisemitism and bring the community together. Moreover, in 2022, CSX partnered with the United Way of Northeast Florida to support and promote Jacksonville’s Civil Rights Conference.

Communities

At CSX, service to our communities is core to who we are and our commitment to people extends beyond our employees. Service is at the heart of every decision we make, for our customers, for our employees and for our communities. We serve the communities in which we live and operate through monetary and in-kind giving, as well as employee volunteerism opportunities. For example, in 2022, CSX contributed $200,000 to support relief and recovery efforts in the Florida and South Carolina communities affected by Hurricane Ian.

Additionally, 2022 marked the fourth full year of our signature community investment initiative, CSX Pride in Service. Pride in Service is a company-wide commitment to honor and serve the nation’s military, veterans and first responders by connecting them and their families with the support they need. CSX understands intimately the sacrifice that comes with military service, as nearly one in five CSX employees have a former or current military connection. Oftentimes, our military, veteran and first responder heroes find themselves with various hardships and financial adversity once they are no longer in the line of duty.

Overall, in 2022, CSX contributed approximately $10.4 million and nearly 12,300 volunteer hours to our communities, with $7 million of such contribution directed to causes supporting military, veterans, first responders and their families. With Pride in Service’s nonprofit partners, CSX makes possible critical financial assistance, community connections and acts of gratitude. In 2022, we reached 315,000+ service men, women and family members through our Pride in Service initiative, and we participated in 751 related service events, partnering with the following organizations:

Our Ongoing Commitment to Social Justice and Racial Equity CSX remains committed to social justice and racial equity—within our organization and throughout our communities. We believe that social justice and racial equity are imperative for expanding economic prosperity for everyone. Our commitment is rooted in strengthening our culture of inclusion and raising our voice and standing with others against racism, and in support of equity and inclusivity for all. CSX supports social justice and combats racial inequities through a detailed action plan that promotes awareness, education and communication, identification, mitigation and elimination of potential or perceived inequities, employee development and voter education. The internal portion of the plan includes specific items that directly impact employees and improve the corporate culture, ranging from sharing diversity metrics and culture survey results and increasing mentoring opportunities and leadership coaching for people of color, to modernizing job titles to remove terminology that may be offensive or have racial connotations and increasing voting awareness internally. Externally, the plan includes partnerships with organizations that promote anti-racism and anti-discrimination education and awareness, provide support for people and communities of color and advance human rights. Employee Engagement ONE CSX is transforming how we engage and listen to our employees and act on their feedback by leveraging existing engagement mechanisms as well as new ways of building strong relationships within our workforce. In addition to town halls—which were resumed in 2022—we engage through people leader communications, small roundtable discussions with senior leaders, our employee intranet and electronic communications, newsletters and fliers available in our field-based offices and training. To complement these efforts, in early 2022, we launched an enterprise-wide employee survey that assessed topics including trust and business ethics, communications and talent management, satisfaction with culture and perceptions of CSX as a company and employer. Responses highlighted that we must continue to work towards critical changes, such as on how we respect, treat and communicate with each other and how we serve our customers and better prepare the railroad and our employees to deliver for our customers. Over the past year and a half, we have been intentional about taking action on and implementing this feedback. Increasing transparency, communications, visibility and support from leaders and managers across the organization—starting with our senior executives—have been among our top priorities accordingly. As another example, responses to the employee survey revealed that many employees did not feel comfortable sharing their ideas. To better foster idea-sharing and reinforce the belief that good ideas come from every corner of the business, we introduced the InnovationX challenge in early 2023. Employees are invited to submit their best ideas for utilizing technology, process enhancement and anything else that sparks their imagination for improving our Company. Funds have been dedicated to exploring creative ideas with the most potential to drive growth and improve safety and service. Additionally, to bolster the communication lines with craft employees—who have invaluable insight from their work in the field—we introduced a technology check-in form through which they are able to submit ideas on technologies, tools and processes CSX can implement to improve the work experience. While we are conducting the next enterprise-wide employee survey in early 2024, we will continue checking in with employees on an ongoing basis by holding discussions with senior leadership and deploying quarterly pulse surveys to measure progress. Social and Community Impact At CSX, service to our communities is core to who we are and our commitment to people extends beyond our employees. Service is at the heart of every decision we make, whether for our customers, our employees or our communities. We serve the communities in which we live and operate through monetary and in-kind giving, as well as employee volunteerism opportunities. For example, in 2023, CSX—one of Jacksonville’s largest employers—announced a landmark $10 million contribution to the University of Florida to support to support the future graduate center, which is poised to redefine the landscape of downtown Jacksonville, and a donation of $1 million to the Jacksonville Zoo and Gardens to support the construction of a new CSX bicentennial train station, symbolizing a commitment to the community and coinciding with the founding anniversary of the railroad. Last year CSX also announced a gift of $5 million to the Baltimore and Ohio (“B&O”) Railroad Museum in Baltimore, Maryland, towards the museum’s $30 million capital campaign in anticipation of the B&O Railroad’s bicentennial anniversary in 2027. As the successor to the B&O Railroad, for nearly 200 years CSX and the B&O Railroad have been integral to the growth of Maryland and Baltimore’s economies and communities; CSX continues to invest in and proudly serve these communities. Additionally, 2023 marked the fifth full year of our signature community investment initiative, CSX Pride in Service. Pride in Service is a company-wide commitment to honor and serve those who serve our country and our communities—our nation’s veterans, military and first responders—by connecting them and their families with the support they need. CSX understands intimately the sacrifice that comes with military service, as nearly one in five CSX employees have served in some capacity, and this cause remains truly important to us. Overall, in 2023, CSX contributed approximately $14 million and CSX employees donated nearly 19,000 volunteer hours and $432,000 to our communities, with $7 million in contributions directed to causes supporting military, veterans and first responders and their families. With Pride in Service’s nonprofit partners, CSX makes possible critical financial assistance, community connections and acts of gratitude. In 2023, we reached 305,000+ service men, women and family members through our Pride in Service initiative, and we sponsored 1,292 community events, partnering with the following organizations:

Creating Value | Governance Governance Practices and Oversight CSX remains committed to strong governance practices and steadfast adherence to the highest standards of ethical conduct. We understand that this is essential to earning and sustaining the trust of our customers, employees, communities, regulators and partners, while also mitigating risks to our business over the long term. At CSX, we believe good governance practices begin with strong leaders who understand the opportunities and challenges across our business and bring diverse perspectives for how to approach them, to help make decisions that support the Company’s long-term growth and success. Our Board of Directors and executive team hold ultimate responsibility for developing and communicating CSX’s vision and purpose, overseeing the implementation of sound governance practices, upholding Company policies, codes, procedures and values and ensuring ongoing monitoring of and adherence to existing and emerging laws and regulations. Key elements of our comprehensive governance program include: nannual election of directors; nmajority voting standard for election of directors and director resignation policy; nqualification guidelines for director candidates, which include consideration of diversity, and review of each director’s performance and continuing qualifications for Board membership; nseparation of the roles of Chair of the Board and CEO; nindependent Chair of the Board; nAudit Committee, Compensation and Talent Management Committee and Governance and Sustainability Committee comprised solely of independent directors; nregular executive sessions of independent directors; nannual evaluation of Board performance; nBoard access to independent advisors; nstock ownership guidelines for directors and officers; nmeaningful limitations on directors’ service on other public company boards; nregular succession planning and effective leadership transitions at the CEO and executive management levels; nno “poison pill” (shareholder rights plan); nproxy access for director candidates nominated by shareholders reflecting standard market practices; nshareholder rights to call special meetings; npolicy against hedging and pledging of CSX common stock; npay-for-performance alignment; and nrobust shareholder outreach and engagement program.

ESG and Sustainable Growth

Governance Practices and Oversight

At CSX, we believe good governance practices begin with strong leaders who understand the opportunities and challenges across our business and bring diverse perspectives for how to approach them, to help make decisions that support the Company’s long-term growth and success. Our Board of Directors and executive team hold ultimate responsibility for developing and communicating CSX’s vision and purpose, overseeing the implementation of sound governance practices, upholding Company policies, codes, procedures and values and ensuring ongoing monitoring of and adherence to existing and emerging laws and regulations. Key elements of our comprehensive governance program include: annual election of directors; majority voting standard for election of directors and director resignation policy; separation of the roles of Chair of the Board of Directors and Chief Executive Officer; independent Chair of the Board of Directors; stock ownership guidelines for officers and directors; policy against hedging and pledging of CSX common stock; proxy access and rights to call special meetings; pay-for-performance alignment; and Audit Committee, Compensation and Talent Management Committee and Governance and Sustainability Committee comprised solely of independent directors.

Business Ethics | | | | | | | | | | | | | | | We prioritize responsible business practices not only because it is the right thing to do, but also because it helps CSX manage and respond to potential risks and opportunities that can have an impact on our business and our ability to provide value to our stakeholders. All CSX employees and officers, members of the Board of Directors and partners conducting business with or on behalf of CSX are expected to act with the highest standards of personal integrity, consistent with the ethical behaviors outlined in our Code of Ethics. This code covers a wide slate of business matters including: conflicts of interest; insider trading; confidential information misuse; discrimination and harassment; whistle-blower protection; public and employee safety; and proper use of corporate assets. In consultation with the Board of Directors, our executive leadership team develops governance policies and sets clear expectations for those across all levels of our Company. Annual ethics training, which focuses on applying the CSX Code of Ethics in daily interactions, is required for all CSX management employees and is highly encouraged for union employees. | | | | | | | Business Ethics | | | | | | | | 2022 Ethics Data

Highlights

| | | | | | | | 100%

Management employees trained

88%

Union employees trained

| | | | | |

We prioritize responsible business practices not only because it is the right thing to do, but also because it helps CSX manage and respond to potential risks and opportunities that can have an impact on our business and our ability to provide value to our stakeholders. All employees and officers of CSX and its wholly-owned subsidiaries, members of the CSX Board of Directors and partners conducting business with or on behalf of CSX are expected to act with the highest standards of personal integrity, consistent with the ethical behaviors outlined in our Code of Ethics. This code covers a wide slate of business matters, including: conflicts of interest; anti-bribery and combatting corruption; insider trading; confidential information misuse; compliance with laws and regulations; discrimination and harassment; whistleblower protection; public and employee safety; and proper use of corporate assets. In consultation with the Board of Directors, our executive leadership team develops governance policies and sets clear expectations for those across all levels of our Company. We require robust annual ethics training, which focuses on applying the CSX Code of Ethics in daily interactions, for all CSX management employees and highly recommend training for union employees. 100% of all active CSX management employees and a majority of CSX union employees completed business ethics training in 2023.In 2022, we began a quarterly series of ethics-related employee communications, including reminders on how employees can report concerns and ask conduct-related questions. Employees are encouraged to anonymously report any suspected violations of the CSX Code of Ethics or other ethical concerns to the 24/7 CSX Ethics Helpline, which is operated by an independent service. CSX strictly prohibits retaliation against anyone who makes a good faith report about a known or suspected violation of our code. Cybersecurity | | | | | | | | | | | | | | | Strong performance and reliability of our technology systems are critical to our ability to operate safely and effectively. Our security framework is broadly integrated across the organization to enable the protection of our customers’ personal information and the integrity of our operations, our contractors and our suppliers. Our information security team is responsible for day-to-day management and strategy implementation, including equipping our systems with the latest cybersecurity tools; conducting daily vulnerability scans; regularly providing critical cybersecurity information to all application users; and facilitating the annual required cybersecurity awarenessStrong performance and reliability of our technology systems are critical to operating safely and effectively, and protecting personal and customer data is essential to maintaining stakeholder trust. CSX maintains a cybersecurity framework that is integrated across the organization through people, processes and technology to help protect the personal information of our customers, contractors and suppliers, as well as the integrity of our own operations. Detail on the oversight of cybersecurity is provided in the “Board of Directors’ Role in Risk Oversight” subsection of the “Corporate Governance” section below beginning on page 45 of this Proxy Statement. 100% of all active CSX management employees completed cybersecurity training in 2023, and a majority of the CSX information security team has industry-recognized cybersecurity certification.trainings.

Over the last few years, CSX has brought in Board and executive-level experts to expand oversight of our cybersecurity and technology systems. In 2019, Suzanne M. Vautrinot, a retired U.S. Air Force (“USAF”) Major General, joined our Board of Directors. Maj. Gen. (ret.) Vautrinot, who led the USAF’s Cyber Command and is currently the president of a cybersecurity strategy and technology consulting firm, provides invaluable expertise and guidance in cyber and information security management. More recently, Stephen Fortune joined CSX as Executive Vice President and Chief Digital & Technology Officer in April 2022. Mr. Fortune brings decades of experience as a corporate technology leader to the Company through his long tenure as Chief Information Officer of the global BP Group.

| | | | | | | Cybersecurity | | | | | | | | 2022 Cybersecurity

Highlights

| | | | | | | | 100%

Management employees trained

90%

Of the information security team has industry-recognized cybersecurity certification

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ITEM 1 Election of Directors As discussed in more detail in the “Corporate Governance” section below beginning on page 19 of this Proxy Statement. | | | | | | | |

The Board unanimously recommends a vote

FOR the election of the following director nominees. | | | | | | | | | | | | | | | | | | | | | | | COMMITTEES KEY | | | | | Chair | | | | | Audit | | | | | Compensation and Talent Management | | | | | Executive | | | | | Finance | | | | | Governance and Sustainability | | | | | | |

| | | | | | | | | 1513 |  2023 Proxy Statement | |

| | | | This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding the Company’s 20222023 performance, please review the 20222023 Annual Report. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | | | ITEM 2

Ratification of Independent Registered Public Accounting Firm

As discussed in more detail in the “Audit Matters” section beginning on page41 of this Proxy Statement.

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | | | ITEM 3

Advisory (Non-Binding) Vote to Approve the Compensation of CSX’s Named Executive Officers

As discussed in more detail in the “Executive Compensation” section beginning on page 45 of this Proxy Statement.

| | | | | | | | | | | | |

Shareholder Outreach and Engagement and Responsiveness to 2022 Say-on-Pay VoteHighlights We conduct and facilitate ongoingsignificant shareholder outreach and engagement throughout the year to ensure that the Board of Directors and management proactively understand and consider our shareholders’ views on important issues includingand are able to elaborate on our executive compensation program. In light of concerns aroundinitiatives and engage in constructive dialogue with our 2022 “Say-on-Pay” vote and given that such vote only received approximately 60% support, well below Company expectations, our shareholder outreach and engagement efforts intensified after our 2022 Annual Meeting and were largely focused on our executive compensation program.shareholders. Below is a summary of the design and breadth of theseour 2023-2024 shareholder outreach and engagement efforts, what we heard from our shareholders and what we did in response. Comprehensive detail on these efforts, respective shareholder feedback and our response responses and our policies and practices regarding shareholder engagement generally—including our other mechanisms for receiving feedback from and engaging with our shareholders—is provided in the “Say-on-Pay“Shareholder Outreach and Shareholder Engagement” subsection of the “Compensation Discussion and Analysis” (the “CD&A”)“Corporate Governance” section below beginning on page 51 of this Proxy Statement. Additional detail related to the Compensation and Talent Management Committee’s perspective on this topic is provided in the letter from the Committee beginning on page 4748 of this Proxy Statement. We strongly encourage you to review each sectionthis subsection for a more fulsome perspective on our 2022robust shareholder outreach and engagement.engagement program. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Conducted Spring Outreach & Identified Common ConcernsDiscussed Key Issues Before the 20222023 Annual Meeting | | | RespondedDetermined Changes to ConcernsPolicies and Practices & Planned Fall Off-Season Outreach | | | Reviewed Corporate Governance Trends & Conducted FallOff-Season Outreach & Considered Feedback Based on the Say-on-Pay Vote | | | Implemented Additional Responsive Actions | | | | | | | | | | | | | | | | | | | | | | Contacted the governance teams of nine15 key shareholders, representing approximately 34.9%40.2% of shares outstanding*outstanding shares* MetReceived a declination (generally due to investors having no concerns) from or met with the governance teams of seven12 of these shareholders, representing approximately 33.5%36.4% of shares outstanding*outstanding shares*

Concerns around the following issues emerged:Areas of focus included:

nthe use ofFeedback on executive compensation committee discretionchanges made in our short-term incentive plan without sufficiently robust disclosures on the committee’s reasoning for applying upward individual performance adjustment(s)response to shareholder feedback in 2022 and any outstanding concerns nthe overall quantum of CEO payBoard composition, refreshment and diversity nthe proportion of our executive pay that is performance basedDirector commitments nthe level of CEO perquisites | | Responded to concerns:

ntransitioned to a new President and CEO with a compensation package that is intended to strike the appropriate balance of fairly compensating him relative to peers and other S&P 500 CEOs, while aligning with shareholder interests and expectationsleadership transition

ncapped the new PresidentEnvironmental and CEO’s personal use of corporate aircraft to $175,000 annuallysustainability initiatives ncommittedCulture, safety and human capital management initiatives | | Responded to key issues: nContinued commitment to more fulsome and specific disclosure of our executive compensation program and resulting payoutsincentive plans performance measures nre-evaluatedAdopted a “Rooney Rule” in connection with director candidates, which requires individuals who self-identify as female and/or a racial or ethnic minority to be included in the circumstances under which individual performance adjustment(s) might be appropriateinitial pool of candidates when selecting new director nominees nreviewedAdopted numerical limits in connection with director commitments, which provide: a director who serves as the equity mixCEO of a public company may not serve on more than three public company boards; and metrics used inall other directors may not serve on more than five public company boards nPublished an enhanced 2022 ESG Report, with more detail on our long-term incentive planvarious strategic initiatives | | Contacted our top 50 shareholders, comprising 41unique firms, representing approximately 56.6% of shares outstanding* Received a declination (generally due to no questions or concerns) from or met withthe governance teams of 1211 of our largest shareholders, representing approximately 32.1%36.3% of shares outstanding*outstanding shares*

Heard:Received feedback from or met with the governance teams of 8 of these shareholders, representing approximately 29.8% of outstanding shares*

Areas of focus included: nbroad support for the changesBoard composition, refreshment and caps in connection with our new President and CEO’s compensation and our commitment to provide more fulsome disclosure of rationale for our compensation decisionsdiversity ndesire to see an increase in the representationDirector commitments nBoard oversight of performance shares in our incentive equity mix, with one shareholder expressing a preference for the use of longer vesting periods for our equity awardsrisk and strategy nSafety nLeadership transitions nEnvironmental and sustainability initiatives | | Implemented additional responsive actions: ndeterminedSelected a slate of director nominees that the circumstances under which individual performance adjustment(s) might be appropriate should be exceptionalis 33% female nincreased the weightingCommitted to more fulsome and specific disclosure of performance units from 50%Board refreshment and oversight of risk and strategy, with particular focus on safety nReplaced operating ratio with operating margin in our short-term incentive compensation plan (effective for 2024) to 60% for our 2023-2025 long-term incentive plan cyclesupport a growth mindset with focus on continued improvement and introduced additional rigor in evaluating an executive’s individual performance | |

* Based on ownership figures as of March 31, 20222023 for spring outreach before the 2023 Annual Meeting and as of September 30, 20222023 for falloff-season outreach. Most meetings were led by the ChairsChair of our Compensation and Talent Management and Governance and Sustainability Committees,Committee and other independent directors in Board leadership positions, along with our Chief Legal Officer, Chief Administrative Officer and/or Head of Investor Relations and employees from these executives’ departments. | | | | | | | | | 1715 |  2023 Proxy Statement | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | | | ITEM 2 Ratification of Independent Registered Public Accounting Firm As discussed in more detail in the “Audit Matters” section below beginning on page 53 of this Proxy Statement. | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Board unanimously recommends that the shareholders vote FOR this proposal. | | | ITEM 3 Advisory (Non-Binding) Vote to Approve the Compensation of CSX’s Named Executive Officers As discussed in more detail in the “Executive Compensation” section below beginning on page 57 of this Proxy Statement. | | | | | | | | | | | | |

Executive Compensation Highlights Alignment with Leading Governance Practices The Compensation and Talent Management Committee has established an executive compensation program that incorporates leading governance principles. Highlightedprinciples, such as those highlighted below, are our executive compensation practices thatwhich drive performance and support strong corporate governance. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | CSX Executive Compensation Practices Include: nStrong pay-for-performance alignment nSignificant percentage of executive compensation that is performance based nPerformance measures with stretch targets that are highly correlated to shareholder value creation nShort-term incentive compensation plan that contains financial, safety, operational and environmental goals nInclusion of multiple financial measures in short and long-term incentive plans nRobust performance management and goal setting processes for the CEO and Executive Vice Presidents nEngagement of an independent compensation consultant to review our executive compensation program and perform an annual risk assessment nSignificant share ownership requirements for Vice President-level executives and above and non-employee directors nDouble trigger in change-of-control agreements for severance payouts (i.e., change of control plus termination) nClawback policy applicable to all incentive compensation plans nInclusion of multiple financial measuresprovisions in short and long-term incentive plans based on a financial restatement or behavioral triggers such as dishonesty, fraud, theft or misconduct, beyond those required under SEC and NASDAQ rules

nUse of payout caps on short and long-term incentives nAnnual “Say-on-Pay” vote | | |  CSX Executive Compensation Practices Do NOT Include / Allow: CSX Executive Compensation Practices Do NOT Include / Allow:nRe-pricing of underwater options without shareholderapproval nExcise tax gross-ups nRecycling of shares withheld for taxes or exercise price nHedging or pledging of CSX common stock nVesting of equity awards with less than a one-year period nEncouraging unreasonable risk taking | | | | | |

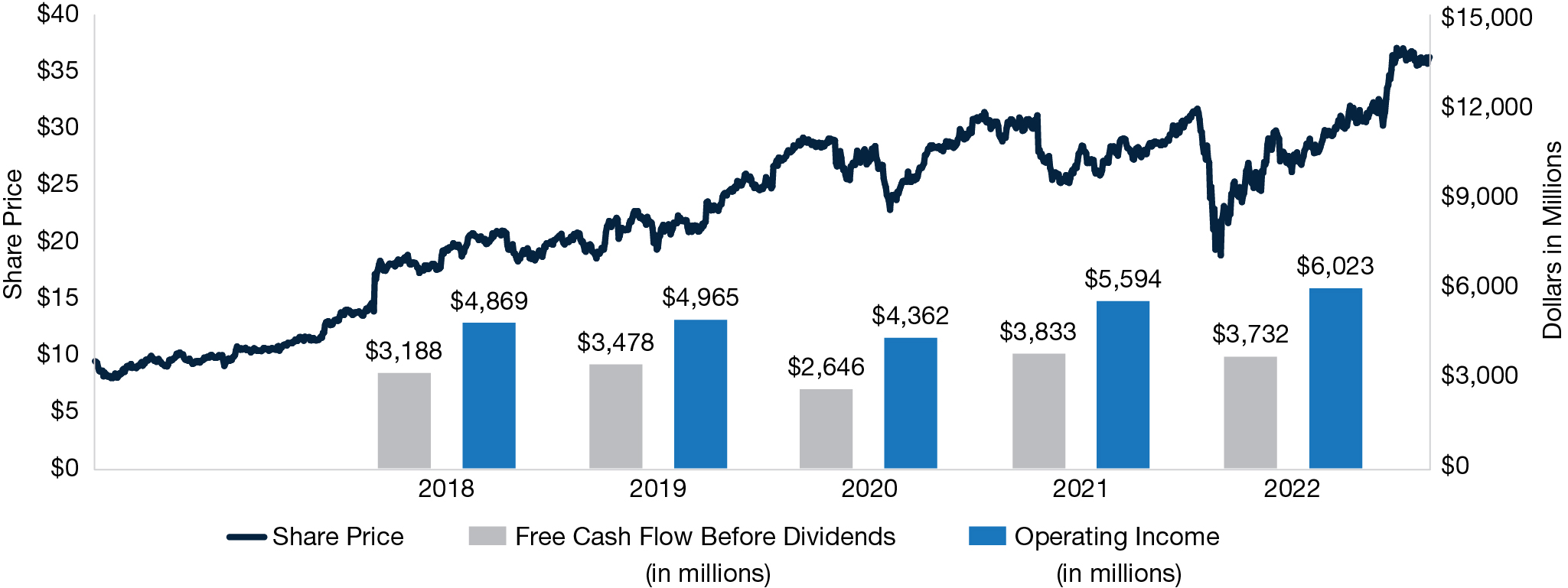

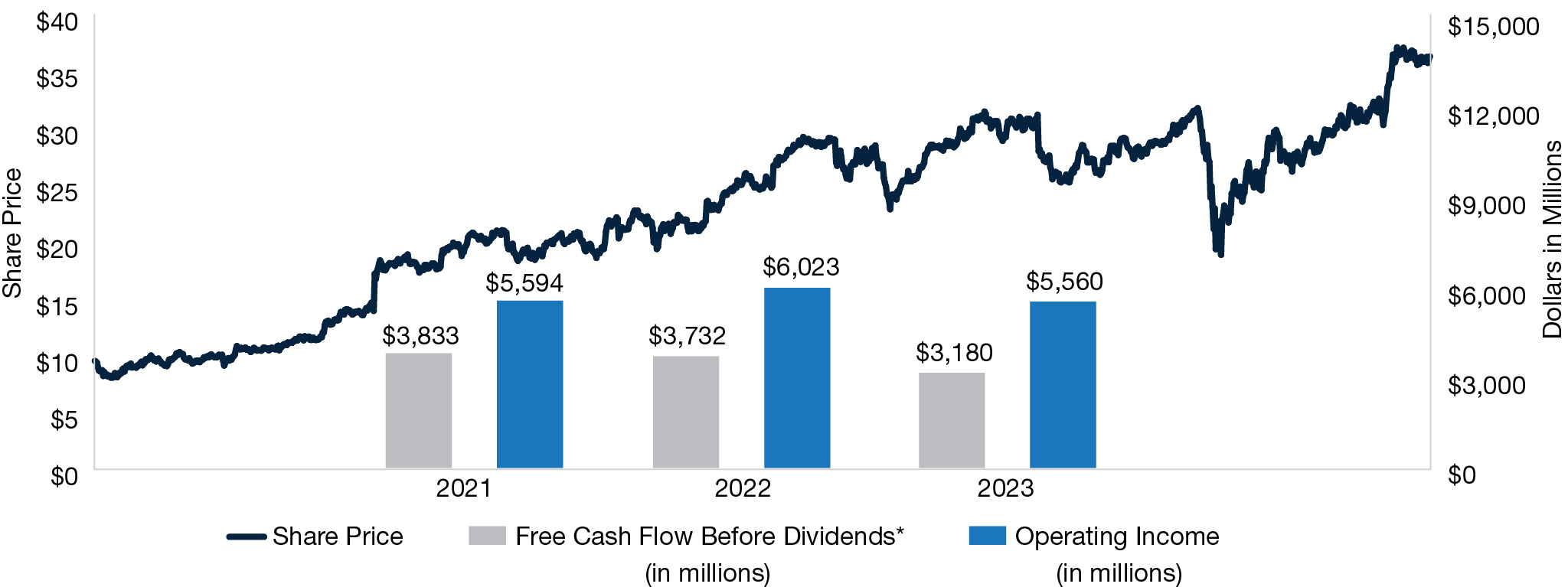

Key Business Highlights for 2022

In 2022, CSX delivered operating income of $6.02 billion, up 8% compared to 2021, and our earnings per share (“EPS”) increased 16% year-over-year to $1.95. In addition, excluding the gains from our 2021 real estate transaction with the Commonwealth of Virginia, our operating income grew in line with our guidance for double-digit growth. For more information on CSX’s performance in 2022, please see the 2022 Annual Report.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | $6.02B

Operating Income

| | 59.5%

Operating Ratio

| | $1.95

Fully-Diluted EPS

| | $5.58B

Capital Returned to Shareholders

|

Stock Performance Graph

The cumulative five-year shareholder returns on $100 invested at December 31, 2017, assuming reinvestment of dividends, are illustrated on the accompanying graph. The Company references the Standard & Poor’s 500 Stock Index (“S&P 500”), which is a registered trademark of The McGraw-Hill Companies, Inc., and the Dow Jones U.S. Transportation Average Index (“DJT”), which provide comparisons to a broad-based market index and other companies in the transportation industry.

| | | Comparison of Five-Year Cumulative Return | |

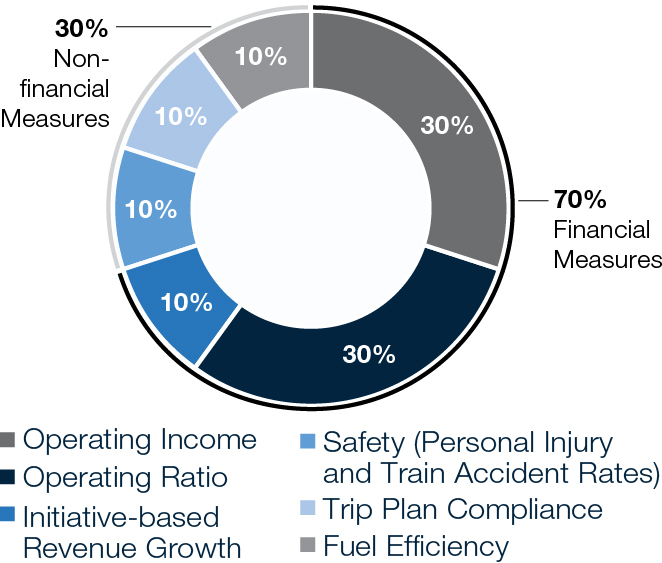

Overview of Incentive Payouts The following tables demonstrate the Company’s 2023 achievements against each target and the overall resulted payout under our 2023 short and long-term incentive plans. | | | | | | | | | | | | | | | | | | | | | | | | | | | 2023 MICP Performance Measure(1) | Threshold(1) (0% – 50% payout) | Target

(100% payout) | Maximum

(200% payout) | Individual Measure Payouts | | Resulted Company Payout | | Total Payout for All NEOs | | Financial Goals – 70% weighting | | | | | | Operating Income (30% weighting) | | 33% | | | | | Operating Ratio(2) (30% weighting) | | 32% | | | | | Initiative-based Revenue Growth(3) (10% weighting) | | 20% | | 115% | | 115%(5) | ESG (Safety and Environmental) and Operational Goals(4) – 30% weighting | | | | FRA Personal Injury Rate (5% weighting) | | 10% | | | FRA Train Accident Rate (5% weighting) | | 0% | | | | | Trip Plan Compliance (10% weighting) | | 20% | | | | | Fuel Efficiency (10% weighting) | | 0% | | | | |

(1)Performance measure payouts are determined independently and each measure could result in a threshold payout range from 0% to 50% as shown, where applicable, in the table. (2)The 2023 MICP terms provided for a formulaic adjustment to the operating ratio performance goal by a predetermined amount if the average cost of highway diesel fuel was outside the range of $4.00 to $4.50 per gallon. This adjustment was designed to account for the potential impact that volatile fuel prices have on expenses and operating ratio. Because the 2023 average price per gallon was $4.21 for highway diesel fuel, which was within the range, there was no adjustment to the operating ratio goal. (3)Initiative-based Revenue Growth is a non-GAAP measure calculated by the amount of newly generated line-haul revenue associated with specific customer initiatives in the year. Line-haul revenue is the revenue generated from moving traffic, excluding fuel surcharge, before any costs or expenses are deducted. (4)Certain safety actuals and operations performance can continue to settle over time. The Company’s 2023 achievements demonstrated in this table reflect actuals as of around the time the Committee approved the overall resulted payout in early 2024. (5)No individual performance adjustments were applied to 2023 payouts for any NEO.

| | | | | | | | | | | | | | | | | | | 2021-2023 LTIP Performance Measure | Threshold

(25% payout) | Target

(50% payout) | Maximum

(100% payout) | | | | | | | | | | | | Payout | Average Annual Operating Income Growth Rate (50% weighting) | | | | | 200% of Target | Cumulative Free Cash Flow(1) (50% weighting) | | | | | | | | | Relative TSR (Modifier) | | -19% | | Total Payout: | | | | | 162% of Target |

(1)Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The Board unanimously recommends athat the shareholders vote FORAGAINST the approval of the frequency of EVERY YEAR for future advisory votes on executive compensation.this proposal. | | | ITEM 4 Advisory (Non-Binding) Vote on Whether Future Votes on the Compensation for the Company’s Named Executive Officers be Held Every One, Two or Three YearsShareholder Proposal Requesting a Railroad Safety Committee

As discussed in more detail in the “Executive Compensation”“Shareholder Proposal” section below beginning on page 45110 of this Proxy Statement. | | | | | | | | | | | | |

| | | | | | | | | | 2024 Proxy Statement | 18 |

| | | | | | | | | | | | | | | | | | | | | | | | | ITEM 1 | Election of Directors | | | | | |

Criteria for Board Membership Overview ElevenTwelve directors are to be elected to hold office for a one-year term beginning in May 2024 until the 2024our 2025 Annual Meeting andor their successors are elected and qualified. The Governance and Sustainability Committee has recommended to the Board of Directors, and the Board has approved, the persons named below as director nominees. The Board believes that each of these director nominees adds to the overall capability and diversity of the Board, including in terms of background, skills, perspective, industries served, business matter coverage and demographics. For example, theseThese director nominees bring a wide range of experience and expertise in management,being senior executives at large and complex organizations, corporate governance, railroad operations and the transportation industry, financial markets and reporting, human capital and risk management.management and sustainability matters. We believe that this broad representation is necessary, as each Board member is expected to be able to assess and evaluate the role and policies of the Company in the face of changing conditions in the economy, regulatory environment and customer expectations.

Additionally, nominees for Board membership are expected to be prominent individuals with demonstrated leadership ability and who possess outstanding integrity, values and judgment. Directors and nominees must be willing to devote the substantial time and capacity required to carry out the duties and responsibilities of directors. In addition, each Board member is expected to represent the broad interests of the Company and its shareholders as a group, and not any particular constituency. With the exception of Joseph R. Hinrichs,Anne H. Chow, who was appointed as the CSX President and Chief Executive Officer andis a member ofnew director nominee on the Company’s Boardslate this year with her own demonstrated record of Directorssignificant capability, experience and expertise as detailed in 2022,the “Board Nominees” section on page 23 below, each of the following nominees was elected to the Board at the Company’s 20222023 Annual Meeting, and each of them has exemplified proven commitment and capacityqualification to serve on the CSX Board. A search firm recommended Ms. Chow to the Board. In addition, to best support the Board’s operating needs, preferred balance and composition and refreshment goals, the Governance and Sustainability Committee has recommended, and the Board has approved, a one-year waiver of the mandatory retirement of Donna M. Alvarado under our policy on director qualifications and selection contained in the CSX Corporate Governance Guidelines and our bylaws. Ms. Alvarado has proven her substantial commitment to the Board since her appointment in 2006, provides in-depth knowledge of the Company and our industry to the Board and has contributed her unique qualifications, personal attributes and perspectives to CSX. We expect a current Board size of 12 directors effective at our 2024 Annual Meeting. Consideration of Diversity CSX strives to cultivate an environment that embraces teamwork and capitalizes on the value of diversity. To ensure that the Governance and Sustainability Committee’s ongoing commitment to diversity is reflected in our director qualifications and selection policies,policy, in 2023, the Board recently amendedadopted a “Rooney Rule” in connection with director candidates. Accordingly, as stated in the revised CSX Corporate Governance Guidelines, individuals who self-identify as female and/or a racial or ethnic minority must be included in the initial pool of candidates when selecting new director nominees. This policy adoption builds on our other recent amendment to these guidelines to specify that suchthe Governance and Sustainability Committee will instruct any third-party search firm to use its best efforts to include qualified candidates who reflect diverse backgrounds, including, but not limited to, diversity of race, ethnicity, national origin and gender. The Governance and Sustainability Committee recognizes the importance of developing and maintaining a Board with a broad scope of backgrounds and expertise that will expand the views and experiences available to the Board in its deliberations. Many factors are taken into account when evaluating director nominees, including experience, skills, education, background, gender, race, ethnicity, age and other qualities and personal attributes. The Governance and Sustainability Committee strongly feels that candidates representing variability across these factors add to the overall diversity and viewpoints of the Board. Moreover, over the past several years, the Board has prioritized ensuring that committee chair positions are held by gender and racially/ethnically diverse Board members. Board diversity, including the diversity of our director nominees, is described in much more detail in the “Board Composition, Refreshment and Diversity” section beginning on page 2937 below.

Corporate Governance | Board Nomination Policies and Practices Board Nomination Policies and Practices We have a comprehensive director qualifications and selection policy with robust criteria for Board membership as described above. Our Governance and Sustainability Committee is responsible for periodically reviewing this criteria, identifying individuals qualified to become Board members and recommending candidates to fill Board vacancies and for election to the Board at the next annual or special meeting of shareholders at which directors are to be elected. In identifying and recommending Board nominees, such committee uses guidelines, consistent with the criteria approved by the Board, that it has developed with respect to qualifications for nominations to the Board and for continued membership on the Board. Sources for our director candidate pool include incumbent directors, management, shareholder nominations and recommendations and third-party search firms, consultants and other advisors, as appropriate. In accordance with the CSX Corporate Governance Guidelines, potential nominees recommended by shareholders will be evaluated on the same basis as individuals identified directly by the Governance and Sustainability Committee or from these other sources. Factors that such committee considers in assessing potential director nominees include: nskills, qualifications, experiences and demonstrated leadership ability; npossession of outstanding integrity, values and judgment; nsufficient time and capacity; noverall Board composition and balance; nthe current and long-term needs of the business; ndiversity and personal attributes; and nindependence and potential conflicts. In addition to these factors, for continued membership on the Board or re-nomination of a director, the Governance and Sustainability Committee also considers: nongoing contribution to the Board’s effectiveness; nfeedback from the annual evaluation of Board performance; nattendance and participation at Board and committee meetings; and nshareholder feedback, including the support received at our Annual Meeting. The Governance and Sustainability Committee ultimately recommends a slate of director nominees that the Board reviews. The Board then nominates the director candidates best qualified to serve the interests of our Company and stakeholders for shareholder consideration and election. We believe that the effectiveness of our Board nomination policies and practices—and relatedly our criteria for Board membership and our policies and practices around Board composition, refreshment and diversity—is evidenced by our nomination of five new highly qualified and largely diverse directors in the past five years. See the “Board Composition, Refreshment and Diversity” section beginning on page 37 below for more information. Director Nominees As of the date of this Proxy Statement, the Board has no reason to believe that any of the following director nominees will be unable or unwilling to serve. If any of the nominees named below is not available to serve as a director at the time of the Annual Meeting (an event which the Board does not now anticipate), the proxies will be voted for the election of such other person or persons as the Board may designate, unless the Board, in its discretion, reduces the size of the Board. There are no family relationships among any of these nominees or among any of the nominees and any executive officer of the Company. Information regarding each of the director nominees follows. Descriptions of key skills and qualifications in these biographies are intentionally limited to emphasize only four notable areas of focus for each nominee and thus are not reflective of all the key skills and qualifications possessed by each director nominee. Nominees have acquired these key skills and qualifications, those additional key skills included in the “Board Key Skills and Experiences” section beginning on page 35 below and others through direct experience, education, training and oversight responsibilities. Each such nomineeof the following director nominees has consented to being named in this Proxy Statement and to serve if elected. | | | | | | | | | | | | | | | | | | The Board unanimously recommends a vote FOR the election of the following nominees. | | | | | |

| | | | | | | | | 19 | 20232024 Proxy Statement | 20 |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Donna M. Alvarado, 7475 Independent Director Nominee Director since 2006 | | | | | | | | | | CSX Committees

Audit/Compensation and Talent Management

Career Highlights nFounder and current President of Aguila International, a business-consulting firm that specializes in human resources and leadership development, since 1994. nServed as President and Chief Executive Officer of Quest International, a global educational publishing company, from 1989 to 1993. nServed as Chairwoman of the Ohio Board of Regents. nAppointed to various executive and legislative staff positions at the U.S. Department of Defense and the U.S. Congress. nAppointed by President Ronald Reagan to lead the federal agency ACTION, the nation’s premier agency for civic engagement and volunteerism. Other Leadership Experience Ms. Alvarado has served on boards in the manufacturing, banking, transportation and service industries. She has also led state and national workforce policy boards. | Key Skills and Qualifications nCorporate Governance Serves as President of Aguila International and previously served as President and Chief Executive Officer of Quest International. Also serves on public company boards, including as the chair of the nominating and governance committee of each of CoreCivic, Inc. and Park National Corporation. nGovernment/Regulated Industries Served in several senior management governmental roles at both the state and federallevels. nRisk/Crisis Management Relevant experience through her roles at the U.S. Department of Defense and on audit committees of public company boards. nHuman Capital Management Expertise in human resources and leadership development through her work at Aguila International. Also served on state and national workforce policy boards. Other Current Public Company Directorships nCoreCivic, Inc. nPark National Corporation | | | | | | | | | | CSX Committee Assignments and Rationale Audit nOversight of company financials, compliance with legal and regulatory requirements and risk management processes in her roles as President of Aguila International and as President and Chief Executive Officer of Quest International. nRisk and crisis management experience obtained through her roles with the U.S. Department of Defense and the U.S. Congress. Also, years of experience on audit committees of public company boards. | | |

Compensation and Talent Management nDecades of experience as the President of a business-consulting firm that specializes in human resources and leadership development. nService on multiple state and national workforce policy boards. Proven leadership on and commitment to promoting diversity, pay equity and inclusion and civic and community involvement. | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Thomas P. Bostick, 6667 Independent Director Nominee Director since 2020 | | | | | | | | | | CSX Committees

Finance/Governance and Sustainability

Career Highlights nChief Executive Officer of Bostick Global Strategies, LLC, a boutique management consulting firm that specializes in areas such as government contracting, engineering, environmental sustainability, human resources, biotechnology, executive coaching, organizational operations and transformation and project management, since 2016. nServed as Chief Operating Officer and President ofIntrexon Bioengineering, a division of Intrexon Corporation, a public company, which seeks to advance biologically engineered solutions to improve sustainability and efficiency, from 2016 to 2020. Led a major restructuring that resulted in Intrexon being renamed as Precigen. nRetired as a U.S. Army Lieutenant General in 2016. nServed as Chief of Engineers and Commanding General of the U.S. Army Corps of Engineers, where he was responsible for most of the nation’s civil works infrastructure and military construction. nServed as the U.S. Army’s Director of Human Resources and led the U.S. Army Recruiting Command. Other Leadership Experience Lt. Gen. (ret.) Bostick was deployed during Operation Iraqi Freedom as second in command of the 1st Calvary1st Cavalry Division and later commanded the U.S. Army Corps of Engineers Gulf Region Division with over $18 billion in construction. He is an independent director on the board of Perma-Fix, a nuclear services company and leading provider of nuclear | and mixed waste management. He serves as an independent trustee on the Equity and High Income Fund Board of Fidelity Investments, Inc., a privately-owned investment management company. He is an independent director on the board of Allonnia, a biotech company focused on environmental challenges, and on the board of HireVue, which uses artificial intelligence and data analytics to transform the way organizations discover, engage and hire the best talent. He is a Member of the National Academy of Engineering and the National Academy of Construction. Key Skills and Qualifications nBusiness Operations Served as Chief Operating Officer and President of Intrexon Bioengineering, now known as Precigen, during an organizational transformation.Precigen. Led the U.S. Army Corps of Engineers, the world’s largest public engineering organization. nGovernment/Regulated Industries Long-tenured service and distinguished career in commanding roles with the U.S.military. nHuman Capital Management Expertise through his service as the U.S. Army’s Director of Human Resources, leadership in the U.S. Army Recruiting Command and work at Bostick Global Strategies, LLC. nSustainability Relevant experience through his leadership and project management oversight at the U.S. Army Corps of Engineers and several companies focused on sustainability and leadership of an ESG subcommittee at Perma-Fix Environmental Services, Inc. Other Current Public Company Directorships nPerma-Fix Environmental Services, Inc. | | | | | | | | | | CSX Committee Assignments and Rationale Finance nOversight of company capital structure, cash flows and key financial ratios or metrics in his role as Chief Executive Officer of Bostick Global Strategies, LLC and as Chief Operating Officer and President of Intrexon Bioengineering. Financial management experience as Chief of Engineers and Commanding General of the U.S. Army Corps of Engineers, where he was responsible for most of the nation’s civil works infrastructure and military construction. nService as an independent trustee on the Equity and High Income Fund Board overseeing equity funds and high-yield funds sponsored by Fidelity Investments, Inc., a privately-owned investment management company. |

Governance and Sustainability nNumerous leadership roles in public and private companies and the U.S. military, with experience in evaluating and overseeing leadership and management structures. nLeadership at the U.S. Army Corps of Engineers and several companies focused on sustainability, including addressing environmental challenges. | | | | |

Corporate Governance | Director Nominees

| | | | | | | | | | | | | | | | | | Anne H. Chow, 57 New Independent Director Nominee | | | | | | | | | | Career Highlights nServed as Chief Executive Officer of AT&T Business from 2019 to 2022, where she was responsible for leading a $35 billion global operating unit comprised of 35,000 people that provided communications and networking solutions to businesses across the world, including nearly all Fortune 1000 companies and the public sector across the U.S. nHeld a variety of other executive leadership positions at AT&T across product management, marketing, sales, customer service and operations, partner ecosystems and network engineering, including President – National Business, President – Integrator Solutions and Senior Vice President – Premier Client Group, since 2000. nCurrently serves as a Lead Director of Franklin Covey, a company dedicated to organizational transformation. Also serves as a director of 3M, a company focused on material science innovation for impact. nFounder of The Rewired CEO, a business services firm, where she has served as Chief Executive Officer since 2022. Other Leadership Experience Ms. Chow has been and is currently involved as a board or advisory member in organizations including the Georgia Tech President's Advisory Board, Dallas Mavericks Advisory Council, Girl Scouts of the USA, New Jersey Chamber of Commerce, the Asian American Justice Center and APIA Scholars. | Key Skills and Qualifications nBusiness Operations Decades of executive leadership positions at AT&T, including as Chief Executive Officer of AT&T Business, where she successfully served customers across nearly all industries while driving business transformation and performance, extensive distribution and global and cross-functional experience in management and a master’s degree in business administration from Cornell University. nCorporate Governance Experience as a director at other public companies, including in board leadership positions such as Lead Independent Director, Chair of the Nominating Committee at Franklin Covey. Substantial local and national nonprofit governance and community advisory experience. nCybersecurity Expertise Proven leadership and expertise as Chief Executive Officer of AT&T Business, where she oversaw the development and deployment of the entire business portfolio suite including fiber, wireless, cloud, 5G, networking, cybersecurity and managed and professional services including partnership ecosystems. nHuman Capital Management Extensive talent management experience through her long-tenured career including roles as Chief Executive Officer and President with deep expertise in talent, culture and inclusion. Currently serves as Senior Fellow and Adjunct Professor of Executive Education at Northwestern University’s Kellogg School of Management. Other Current Public Company Directorships nFranklin Covey Co. n3M | | | | | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Steven T. Halverson, 6869 Independent Director Nominee Director since 2006 | | | | | | | | | | CSX Committees

Audit/Compensation and Talent Management (Chair)/Executive

Career Highlights nServed as Chairman from 19992010 to 2021, and President and Chief Executive Officer from 1999 to 2018, of The Haskell Company, one of the largest design-build and engineering and construction firms in the U.S. nServed as Senior Vice President of M.A. Mortenson, a national construction firm. nCurrently servesServed as a director from 2014 to 2023 of GuideWell Mutual Holding Corporation, a not-for-profit company that is the parent to a family of companies focused on advancing health care, including health insurance group Blue Cross and Blue Shield of Florida, for which Mr. Halverson also currentlyserved as a director from 2010 to 2023. nCurrently serves as a director.director of Gilbane, Inc., a 150-year old global real estate and construction company that is one of the nation’s largest companies in its industries. Other Leadership Experience Mr. Halverson has served as the chair of professional and business organizations such as the Construction Industry Roundtable, the Design-Build Institute of America and the National Center for Construction Education and Research. He has also served as the chair of several civic organizations, including the Florida Council of 100, the Florida Chamber of Commerce and the Jacksonville Civic | Council. He is a certified fellow of the National Association of Corporate Directors and received certification in ESG Governance from Berkley Law School. Key Skills and Qualifications nBusiness Operations Decades of relevant experience through his service as Chairman, President and Chief Executive Officer of The Haskell Company and executive positions with M.A. Mortenson, during which he gained extensive and unique insight on the national construction industry and, accordingly, the U.S. economy. nCorporate Governance Led as Chairman of The Haskell Company and the chair of various professional, business and civic organizations. nGovernment/Regulated Industries Served on multiple civic councils, appointed boards and commissions, through which he helped advise on and advocate for federal, state and local economic policies. nHuman Capital Management Expertise through his long-tenured role as Chief Executive Officer and significant service on compensation committees focused on talent management. Other Current Public Company Directorships nNone | | | | | | | | | | CSX Committee Assignments and Rationale Audit nOversight of financial statements, compliance with legal and regulatory requirements and risk management processes in his decades-long tenure as Chairman, President and Chief Executive Officer of The Haskell Company and from his broader experience with the national construction industry. nKnowledge of legal, regulatory and policymaking risks and processes through his years of leadership experience with organizations in highly regulated industries and on multiple civic councils. Also, many years of experience serving on the CSX Audit Committee. |

Compensation and Talent Management (Chair) nHuman capital management expertise gained through his many years of leadership as President and Chief Executive Officer of The Haskell Company. Proven commitment to civic and community involvement. nExtensive service on compensation committees of public company boards, including 14 years serving as the Chair of the CSX Compensation and Talent Management Committee. | | | | | | Executive nAppointed due to his role as Chair of the Compensation and Talent Management Committee. | | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Paul C. Hilal, 5657 Independent Director Nominee / Vice Chair of the Board Director since 2017 | | | | | | | | | | CSX Committees

Executive/Finance/Governance and Sustainability

Career Highlights nFounder and Chief Executive Officer of Mantle Ridge LP, an investment fund formedfirm founded in 2016.2016 that actively stewards and assists portfolio companies. nServes as Vice Chairman of Dollar Tree. nServed as Vice Chairman of Aramark from 2019 to 2023. nServed as a partner and senior investment professional at Pershing Square Capital Management from 2006 to 2016. nServed as a director of Canadian Pacific Railway Limited from 2012 to 2016, where he was the chair2016. nServed as Chairman and acting Chief Executive Officer of the Management ResourcesWorldtalk Communications from 1999 to 2000. nDecades’ worth of experience serving on or leading governance committees, compensation committees, finance committees and Compensation Committee and a memberexecutive committees of the Finance Committee.public-company boards. Other Leadership Experience Mr. Hilal currently serves on the Board of Overseers of Columbia Business School and previously served on the Board of the Grameen Foundation, an umbrella organization that helps micro-lending and micro-franchise institutions empower the world’s poorest through financial inclusion and entrepreneurship. | Key Skills and Qualifications nCorporate Governance ServesCurrently serves as Vice Chairman of Aramark. Has alsoDollar Tree and previously served in board leadership positions atother public companies, including as Vice Chairman of WorldTalkAramark and Chairman of Worldtalk Communications. Over a decade of experience serving on nominating and governance committees. nFinance/Capital Allocation Extensive experience with leading capital management organizations, including control of his own capital management firm. Proven expertise as a value investor, capital allocator and engaged director driving shareholder value. nHuman Capital Management Relevant talent management experience through his role as a Chief Executive Officer, in senior management positions and as a director. nTransportation Industry/Supply Chain Management Railroad industry experience and perspective through his service as a director of Canadian Pacific Railway Limited.Limited in addition to his long tenure of service on the Board of CSX. Other Current Public Company Directorships nAramark nDollar Tree

| | | | | | | | | | CSX Committee Assignments and Rationale Finance nExtensive experience in senior leadership roles of investment and capital management organizations. Expertise with investment policies, capital allocation, financing and policies and practices related to driving shareholder value. nYears of service on finance committees of public company boards, including of Canadian Pacific Railway Limited and Dollar Tree, Inc., in addition to CSX. Executive nAppointed due to his role as Vice Chair of the Board of Directors. |

Governance and Sustainability nCorporate governance experience gained through several board leadership roles at public companies, including service as Chairman of Worldtalk Communications and Vice Chairman of the boards of CSX, Dollar Tree and Aramark. These include more than a decades’ worth of experience on nominating and governance committees. Also, oversight of governance matters in his role as Founder and Chief Executive Officer of his own investment firm. nExperience with sustainability policies, strategies and programs and political giving policies and community affairs activities through his roles as a value investor and engaged steward during corporate transformations and his service on the Board of Overseers of Columbia Business School and the Board of the Grameen Foundation. | | | | |

| | | | | | | | | 2125 |  2023 Proxy Statement | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Joseph R. Hinrichs, 5657 Management Director Nominee / President and Chief Executive Officer Director since 2022 | | | | | | | | | | CSX Committees

Executive (Chair)

Career Highlights nServed as President of Ford Motor Company’s global automotive business from 2019 to 2020, where he led the company’s automotive operations. Previously held other positions at Ford, including President of Global Operations, from 2017 to 2019, President of the Americas, from 2012 to 2017, and President of Asia Pacific and Africa, from 2009 to 2012. nCurrently serves as: a member of the board of directors of The Goodyear Tire & Rubber Company; Chairman of the board of directors of Exide Technologies, a battery manufacturer and leading provider of advanced energy solutions; a venture partner at First Move Capital, an investment firm; an automotive advisory board member at Luminar Technologies, a global automotive technology company ushering in a new era of vehicle safety and autonomy; and a strategic advisor at mircroDrive, a company in the advertising services industry that provides a SaaS platform created specifically for hyper-local influencer marketing. nServed as a partner and Senior Vice President at Ryan Enterprises, a private equity group. nSpent 10 years at General Motors in various engineering and manufacturing leadership roles. nServed as Chairman of the National Minority Supplier Development Council from 2016 to 2019 and also served on the boards of CEO Climate Dialogue, Climate Leadership Council and the U.S.-China Business Council. | Other Leadership Experience Mr. Hinrichs has more than 30 years’ experience in the global automotive, manufacturing and materials planning and logistics sectors. He has served on the boards of several other companies, including Rivian Automotive, Inc., Ford Motor Credit Company, GPR and Ascend Wellness Holdings. Key Skills and Qualifications nBusiness Operations Decades of relevant experience through his senior management positions with Ford Motor Company, where he enabled Ford to execute world-class manufacturing on a global scale, and other leadership and advisory roles. nHuman Capital Management Proven track record during his tenure in leadership positions, especially at Ford Motor Company, around employee engagement, building a one-team workforce and prioritizing safety and an inclusiveculture. nTransportation Industry/Supply Chain Management Extensive automotive industry experience and perspective through his service at Ford Motor Company and General Motors, which is an industry with dynamics similar to rail. nSustainability Demonstrated commitment to sustainability in his work at Ford Motor Company, advisory services to companies advancing electric vehicle adoption and leadership on climate organizations. Other Current Public Company Directorships nNoneThe Goodyear Tire & Rubber Company | | | | | | | | | | CSX Committee Assignments and Rationale Executive (Chair) nAppointed due to his role as Chief Executive Officer of CSX. | | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | David M. Moffett, 7172 Independent Director Nominee Director since 2015 | | | | | | | | | | CSX Committees

Audit (Chair)/Executive/Finance

Career Highlights nServed as Chief Executive Officer and a director of the Federal Home Loan Mortgage Corporation from 2008 until his retirement in 2009. nServed as a Senior Advisor with The Carlyle Group, one of the world’s largest and most diversified global investment firms, from 2007 to 2008. nServed as Vice Chairman and Chief Financial Officer of U.S. Bancorp from 2001 to 2007, after its merger with Firststar Corporation. nServed as Vice Chairman and Chief Financial Officer of Firststar Corporation from 1998 to 2001. nServed as Chief Financial Officer of StarBanc Corporation, a predecessor to Firststar Corporation, from 1993 to 1998. Other Leadership Experience Mr. Moffett serves as a trustee on the Board of Columbia Fund Series Trust I and ColumbiaThreadneedle Mutual Funds, Variable Insurance Trust, overseeing approximately 52170 funds within the Columbia Funds mutual fund complex. He also serves as a trustee for the University of Oklahoma Foundation and has served as a consultant to Bridgewater and Associates.

| Key Skills and Qualifications nCorporate Governance Substantial leadership experience as an executive and vice chair of major financial institutions and as a trustee in connection with Columbia Funds and the University of Oklahoma Foundation. nFinance/Capital Allocation Served for many years as a Chief Financial Officer in the banking industry, during which he was responsible for financial and asset management. nAccounting/Financial Reporting Extensive expertise in corporate accounting and reporting and overseeing financial statements through decades of leading financial institutions. nRisk/Crisis Management Served in senior management roles in the risk-intensive and highly regulated banking industry for more than 30 years and on audit committees of public company boards, including as the chair of the audit committee of PayPal. Other Current Public Company Directorships nPayPal Holdings, Inc. | | | | | | | | | | CSX Committee Assignments and Rationale Audit (Chair) nDecades of experience in corporate accounting and oversight of financial statements, compliance with legal and regulatory requirements, risk management processes and internal audit functions through his significant leadership roles in the financial services and banking industry, which is a risk-intensive and highly regulated industry. Also, years of experience on audit committees of public company boards, including as the chair of the audit committee of PayPal. nMeets the qualifications of an “Audit Committee Financial Expert” as defined by SEC rules and regulations. |

Finance nMany years of service in senior leadership roles in the banking industry, including as chief executive officer and chief financial officer. nCapital allocation and strategic financial expertise gained through his direct oversight of financial and asset management for major financial institutions. | | | | | | Executive nAppointed due to his role as Chair of the Audit Committee. | | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Linda H. Riefler, 6263 Independent Director Nominee Director since 2017 | | | | | | | | | | CSX Committees

Compensation and Talent Management/Executive/Governance and Sustainability (Chair)

Career Highlights nServed as Chair of Global Research at Morgan Stanley from 2011 to 2013, after having served as Global Head of Research since 2008. nServed as Chief Talent Officer at Morgan Stanley from 2006 to 2008. nServed on both the Management and the Operating Committees at Morgan Stanley. nJoined Morgan Stanley in 1987 in the Capital Markets division and was elected a managing director in 1998. nServes on the executive leadership team of Stanford Women on Boards, whose mission is to cultivate and place exceptional women for board services. nServed on the boards of Stanford Graduate School of Business and Choate Rosemary Hall. Other Leadership Experience Ms. Riefler has served on the board of North American Partners in Anesthesia, a private equity-owned national health care company, since 2016. She is also the former chair of an educational non-profit, Pencils of Promise, whichis committed to literacy in global rural underservedcommunities. | Key Skills and Qualifications nCorporate Governance Relevant experience and perspective through her service on the executive leadership team of Stanford Women on Boards and various boards, including as the chair of the compensation committee at MSCI, Inc. Expertise and commitment to leadership on corporate governance reflected in her co-authorship of the Stanford Women on Boards “Leading-Edge Stewardship: A Roadmap to Board Excellence.Excellence” and a companion piece “Leading-Edge Stewardship: A Personal Roadmap for Building Your Personal Effectiveness in the Boardroom.” Recognized for her “outstanding work by an independent director” at the 2023 Corporate Governance Awards, hosted by Governance Intelligence (formerly Corporate Secretary). nFinance/Capital Allocation In-depth knowledge of company valuation and the global capital markets through her decades of service at Morgan Stanley. Long board tenure with MSCI, Inc., a global provider of indices and decision support tools and services. nHuman Capital Management Expertise in talent management through her role as Chief Talent Officer at Morgan Stanley. Commitment to diversity, including in board composition, reflected through her service at Stanford Women on Boards. nSustainability Extensive experience through 1516 years’ of service on the board of MSCI, Inc., a global leader in ESG and climate-related research and solutions. Other Current Public Company Directorships nMSCI, Inc. | | | | | | | | | | CSX Committee Assignments and Rationale Compensation and Talent Management nHuman capital and talent management expertise acquired through her tenure as Chief Talent Officer for Morgan Stanley. Also, years of experience as the chair of the compensation committee at MSCI, Inc. nProven commitment to diversity, pay equity and inclusion demonstrated through her service on the leadership team of Stanford Women on Boards and service on the board of a non-profit committed to underserved communities. Executive nAppointed due to her role as Chair of the Governance and Sustainability Committee. | | |

Governance and Sustainability (Chair) nExtensive corporate governance experience and expertise through her service on the executive leadership team of Stanford Women on Boards and various boards, demonstrated through her leadership on considering and adopting good governance practices, including at CSX, and co-authorship of material on board governance. nValuable insights and commitment to sustainability developed through her 16 years of service on the board of MSCI, Inc., a global leader in ESG and climate-related research and solutions, and reflected in her engagement in opportunities to stay informed on the changing industry, societal and regulatory landscapes, stakeholder expectations and ESG issues. | | | | |

Corporate Governance | Director Nominees | | | | | | | | | | | | | | | | | | Suzanne M. Vautrinot, 6364 Independent Director Nominee Director since 2019 | | | | | | | | | | CSX Committees

Audit/Governance and Sustainability

Career Highlights nPresident of Kilovolt Consulting, Inc., a cybersecurity strategy and technology consulting firm, since October 2013. nRetired from the U.S. Air Force (USAF)(the “USAF”) as a Major General in 2013, following a distinguished 31-year career. nServed as Commander of various satellite, space surveillance and space command and control units from 1996 to 2008. nServed as Commander of the USAF Recruiting Command. nServed as Commander of the USAF’s Cyber Command from 2011 to 2013. nServed as Deputy Commander for the Joint ForcesFunctional Component Command Network andCommand-Network Warfare. nServed as the USAF Director of Plans and Policy, U.S. Cyber Command, Deputy Commander, Network Warfare, U.S. Strategic Command and Commander, USAF Recruiting Service.Command. nInducted into the National Academy of Engineering. Other Leadership Experience Maj. Gen. (ret.) Vautrinot serves in board leadership positions at other public companies, including as Chair of the Safety, Health and Environment Committee of Ecolab Inc., Chair of the Nominating and Governance Committee atParsons Corporation and former Chair of the Technology | Subcommittee of the Risk Committee of Wells Fargo & | Company. She also served as a director of Norton Life Lock Inc. (formerly Symantec Corporation) from 2013 to 2019. She is currently a member of the NACD Climate Advisory Council. Key Skills and Qualifications nBusiness Operations During her 31-year career in leadership and commanding roles at the USAF, oversaw a multibillion-dollarmulti-billion dollar cyber enterprise and led a workforce of 14,000 personnel conducting offensive and defensive cyber operations worldwide. nRisk/Crisis Management Extensive relevant experience through her service in the USAF in creating, operating and protecting U.S. space and cyber assets globally. nHuman Capital Management Expertise in workforce development and talent management through her years in USAF leadership positions and as Commander of the USAF Recruiting Service. nCybersecurity Expertise Proven leadership and expertise as President of Kilovolt Consulting, Inc. and led the USAF’s Cyber Command and the Joint ForcesFunctional Component Network andCommand-Network Warfare. Other Current Public Company Directorships nEcolab Inc. nParsons Corporation nWells Fargo & Company | | | | | | | | | | CSX Committee Assignments and Rationale Audit nExtensive cybersecurity and technology experience and expertise obtained through her distinguished service in the USAF, including as Commander of the USAF’s Cyber Command, and as Deputy Commander for the Joint Functional Component Command-Network Warfare, where she influenced the development and application of critical cybersecurity technology and the oversight, creation and protection of U.S. cyber assets. Also, over a decade of experience as the President of a cybersecurity strategy and technology consulting firm. nDeep risk and crisis management expertise through her 31-year career in leadership and commanding roles at the USAF, including defending U.S. space and cyber assets globally, and her service on the Risk Committee and as Chair of the Technology Subcommittee of the Wells Fargo board, as well as service on the board of Norton Life Lock (formerly Symantec Corporation). Also, years of experience on audit committees of public company boards. |

Governance and Sustainability nOversight of governance matters as the President of Kilovolt Consulting, Inc. and through her leadership roles in the U.S. military, which includes experience in evaluating and overseeing leadership and management structures. Also, years of service in multiple board leadership positions at other public companies. nExperience with sustainability policies, strategies and programs through her roles as Chair of the Safety, Health and Environment Committee of Ecolab Inc. and on the Corporate Governance & Responsibility Committee of Parsons Corporation and the Corporate Responsibility Committee of Wells Fargo & Company. | | | | |

| | | | | | | | | 2329 |  2023 Proxy Statement | |